T-bill yield rises and Singapore stocks hit new highs: Weekly Market Recap

By Gerald Wong, CFA • 04 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The 6-month Singapore T-bill yield rose to 1.6% and Singapore stocks reached record highs.

After I sent out last week’s Weekly Sprout, I headed to my usual hawker centre for Sunday lunch.

Just as I was finishing my meal, someone walked up and asked, “Are you… Beansprout?”

For a split second, I froze. Most of the time when someone approaches me at a hawker centre, it’s to ask whether the seat is taken.

I said yes, he gave a short word of encouragement and went on his way. But that short moment stuck with me.

It reminded me why building Beansprout has been so meaningful.

Over the past few years, I’ve had many conversations with our readers. They may be short, but they remind me that behind every click, read, or comment, there’s someone trying to make thoughtful financial decisions, support their families, and build a more secure future, one step at a time.

And as we begin 2026, that is the theme I keep coming back to - starting the year with purpose and being intentional about what we want our money to do for us.

To kick off the year, we’ve already seen the 6-month Singapore T-bill yield jump to 1.6%, and best fixed deposit rates inching up from their lows.

2025 was also a strong year for Singapore stocks. This week, we round up the best-performing blue-chip stocks and Next 50 stocks, and explore what’s been driving Singapore’s market strength.

And if you’d like to say hi to the Beansprout team in person (hopefully not just at hawker centres!), we’ll be at the FSM Invest Expo 2026 on 17 January, together with experts sharing their market outlook. Sign up for free here.

Thank you for being with us through the past year, and for letting us be part of your financial journey. Wishing you a purposeful start to 2026, and a year of meaningful growth ahead.

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Accelerating growth

What happened?

Singapore’s economy expanded by 5.7% year-on-year in the fourth quarter of 2025, picking up from the 4.3% growth recorded in the previous quarter.

For the full year, GDP growth came in at 4.8%, an improvement from 4.4% in 2024.

The stronger performance was supported mainly by the manufacturing sector, driven by output growth in the biomedical manufacturing and electronics clusters.

What does this mean?

Economic growth in 2025 came in stronger than expected, even exceeding MTI’s revised forecast of “around 4%”, which had already been raised from the earlier projection of 1.5% to 2.5%.

Looking ahead, MTI had earlier guided in November 2025 that growth in 2026 is expected to moderate to between 1% and 3%. This reflects expectations that the impact of US tariffs will become more pronounced in the year ahead.

Why should I care?

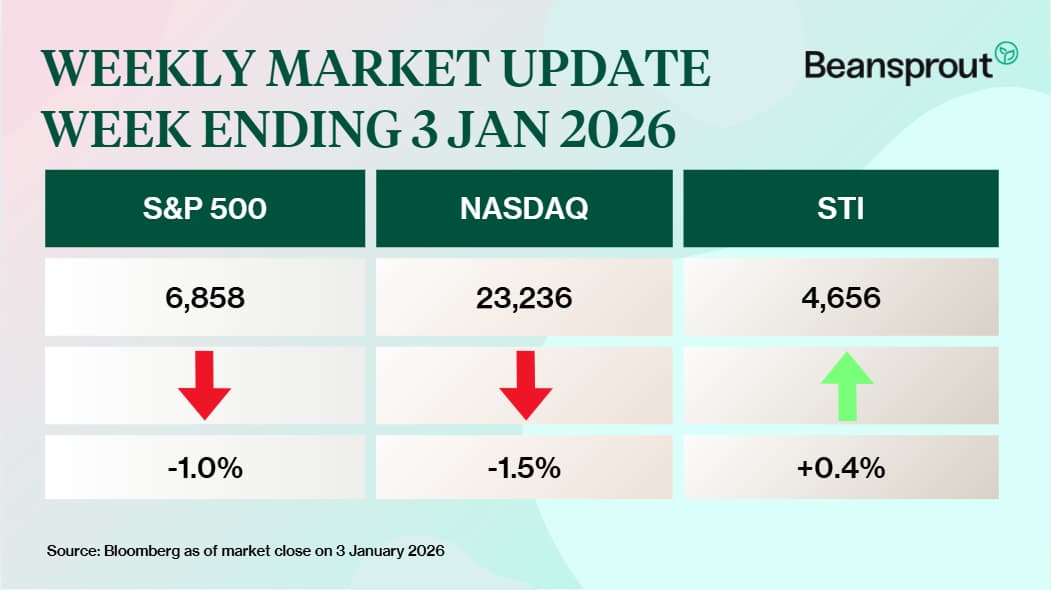

Singapore’s Straits Times Index (STI) kicked off the new year on a strong note, closing at a new high of 4,656.12 on 2 January 2026.

The gains were led by property stocks and REITs — CapitaLand Investment rose 1.9%, while Mapletree Industrial Trust, Mapletree Logistics Trust and Frasers Logistics & Commercial Trust each gained around 1.5%.

This came even as US markets saw a mild pullback, with the S&P 500 down 1.0% and the Nasdaq declining 1.5%.

🚗 Moving This Week

- ST Engineering said that it expects to report a positive net profit for the second half of 2025, after factoring in all one-off items. This follows its Nov 12 guidance of a positive full-year net profit, supported by strong underlying operations, although H2 earnings were still under review at the time. Read more here.

- Keppel will aim to “sustainably monetise” its non-core assets by 2030 to unlock significant capital for growth investments, debt reduction and shareholder returns, chief executive officer Loh Chin Hua said on Thursday (Jan 1). In his New Year message to staff, Loh noted that the group has made solid progress in asset monetisation despite challenges in markets such as China’s real estate sector. Read more here.

- UltraGreen.ai has secured dual market regulatory approvals for two of its products less than a month after its trading debut on the Singapore Exchange. The company obtained approval in the Philippines for Verdye, a fluorescence dye used in fluorescence-guided surgery, and regulatory clearance in Malaysia for its IC-Flow Imaging System V2, a medical infrared camera system that captures fluorescent images during surgical procedures. Learn more about UltraGreen.ai here.

- Co-living operator The Assembly Place filed a preliminary prospectus on Monday (Dec 30) for a proposed listing on the Catalist board of the Singapore Exchange (SGX). The company runs an asset-light business model, managing and operating a portfolio that spans co-living spaces, hotels and student accommodation. It bills itself as Singapore’s “largest and most diversified” co-living operator, with about 3,422 keys across 100 properties in Singapore as at Dec 17.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

Top 3 Singapore blue chip stocks in 2025. Is there more upside?

We look at the top 3 Singapore blue chip stocks with the best share price performance in 2025 and see if their rally can be sustained.

🤓 What we're looking out for next week

- Friday, 9 January 2026: US non-farm payroll data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments