Beyond Blue Chips - 5 Top-performing Singapore Next 50 stocks in 2025

Stocks

By Gerald Wong, CFA • 31 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are the 5 best performing Singapore Next 50 stocks that saw more gains compared to blue chips in 2025.

What happened?

Singapore stocks have performed well in 2025.

Earlier this week, we looked at the 3 top-performing Singapore blue-chip REITs in 2025 as well as the 3 SGX-listed REITs that have outperformed in the wider S-REIT market.

With the launch of the iEdge Singapore Next 50 Index, we see growing attention in the mid-cap stocks beyond Singapore REITs and the blue-chips.

Among the iEdge Singapore Next 50 Index constituents, there are several that saw gains of more than 100%.

In this article, we take a closer look at the five best-performing iEdge Singapore Next 50 stocks year-to-date, and examine whether their dividend yields are as attractive.

The 5 Best Performing iEdge Singapore Next 50 Stocks in 2025

#1 - Hong Leong Asia (SGX: H22)

Hong Leong Asia is the trade and industry arm of the Hong Leong Group.

It operates as a diversified Asian multinational with core businesses in powertrain solutions through its subsidiary China Yuchai International, and building materials such as cement, precast concrete, and ready-mix concrete in Singapore and Malaysia.

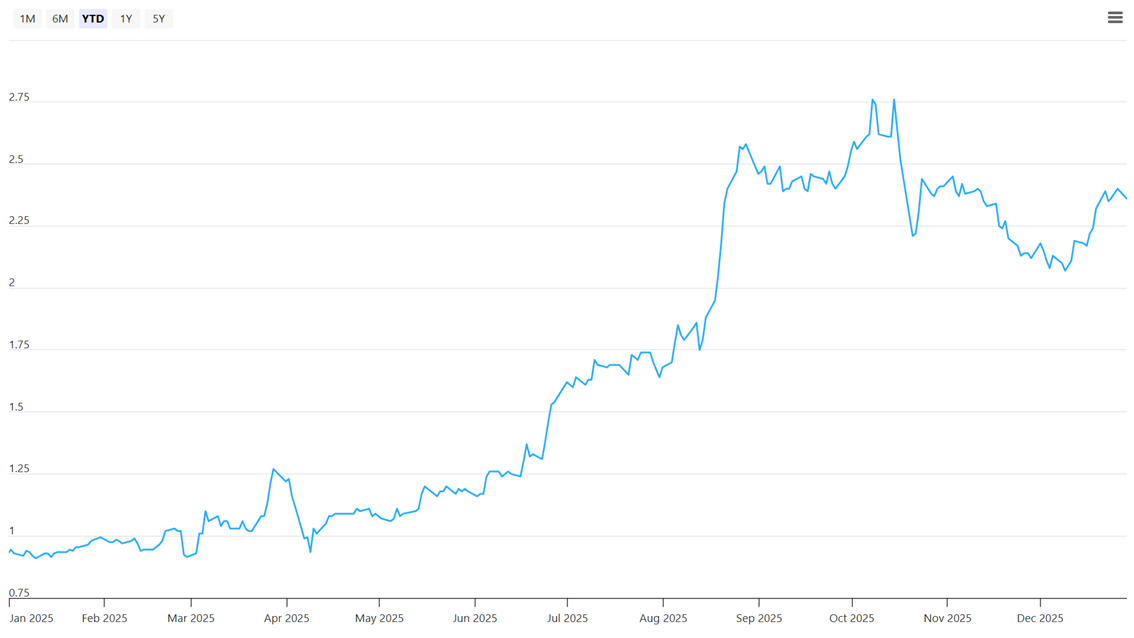

Coming in first place, Hong Leong Asia share price has rallied approximately 159.3% year-to-date as of 29 December 2025.

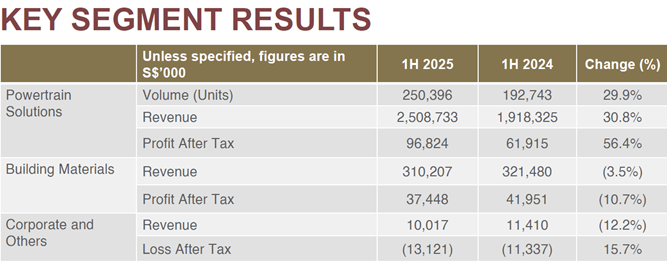

For the first half ended 30 June 2025 (1H2025), Hong Leong Asia reported a 13.1% year-on-year increase in net profit attributable to owners (PATMI) to S$56.1 million.

Revenue rose 25.7% to S$2.83 billion, driven primarily by the powertrain solutions division, which saw sales surge as the commercial vehicle market in China recovered.

Group gross profit expanded 18.5% to S$427.5 million, though gross margin moderated to 15.1% (from 16.0%) due to product mix and RMB weakness.

Profit before tax jumped 31% YoY to S$121 million, driven by volume growth and operating efficiencies at Yuchai.

Net profit attributable to shareholders (PATMI) was S$56.0 million (+13.1% YoY). Excluding a one-off associate gain in 1H 2024, core PATMI rose 21.2% YoY.

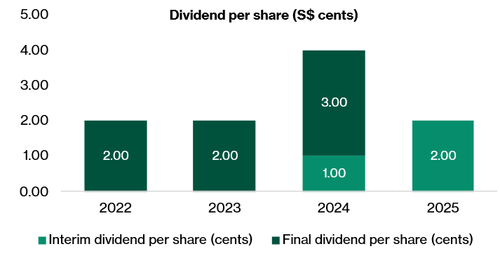

The company doubled its interim dividend from S$1.0 cents in 1H FY2024 to S$2.0 cents per share for 1H FY2025.

The company maintains a solid balance sheet with a net cash position, supported by disciplined capital management and improving visibility on margin expansion across its key business segments.

Related links:

- Hong Leong Asia - Net cash position powering medium term growth

- Hong Leong Asia share price history and share price target

- Hong Leong Asia dividend forecast and dividend yield

#2 - Food Empire Holdings (SGX: F03)

Food Empire is a global branding and manufacturing company in the food and beverage sector.

Its portfolio includes instant coffee, confectionery, and snacks, with leading brands like MacCoffee.

The Group has a strong presence in markets such as Russia, Ukraine, Kazakhstan, Commonwealth of Independent States (CIS) countries, and Southeast Asia.

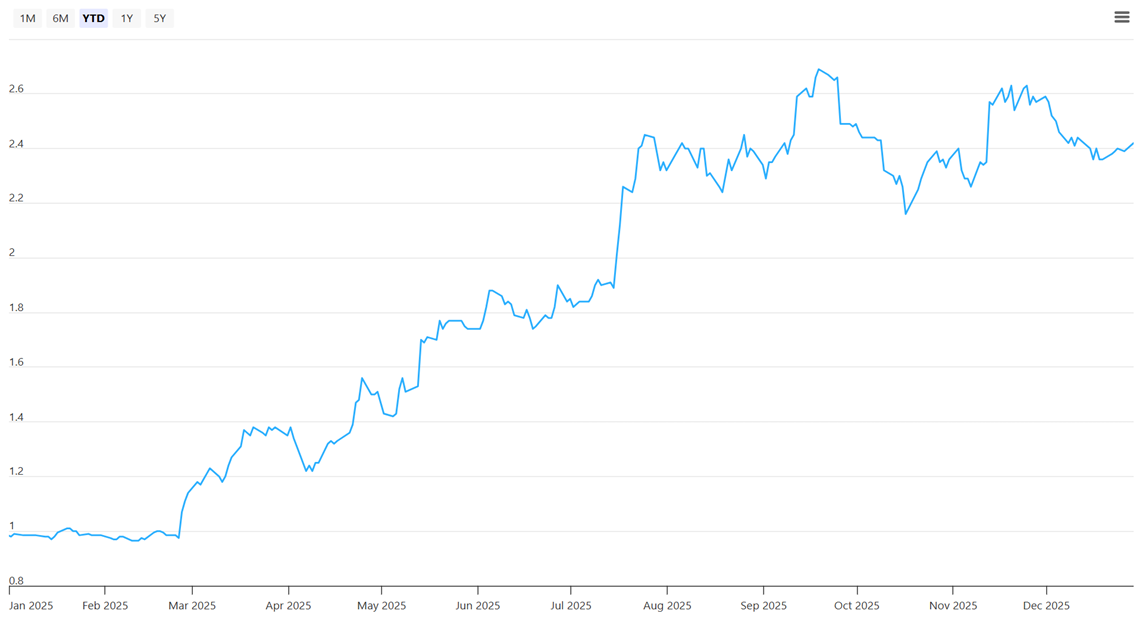

Food Empire Holdings has climbed approximately 144.4% year-to-date as of 29 December 2025, taking the second spot.

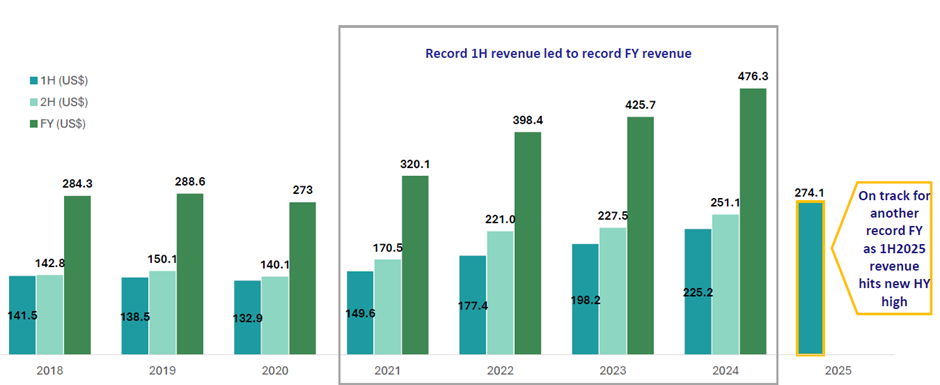

For 1H2025, Food Empire achieved record revenue of US$274.1 million, a 21.7% increase from the previous year.

Growth was broad-based, with the Southeast Asia segment recording the highest growth of 25.3% rise in revenue for 1H2025.

While reported net profit was impacted by a one-off non-cash fair value loss, normalised net profit grew 35.7% to US$31.5 million.

In its 3Q2025 business update, the Group reported that revenue jumped 28.3% to US$152.6 million, driven by a particularly strong quarter in its Russia and CIS segments.

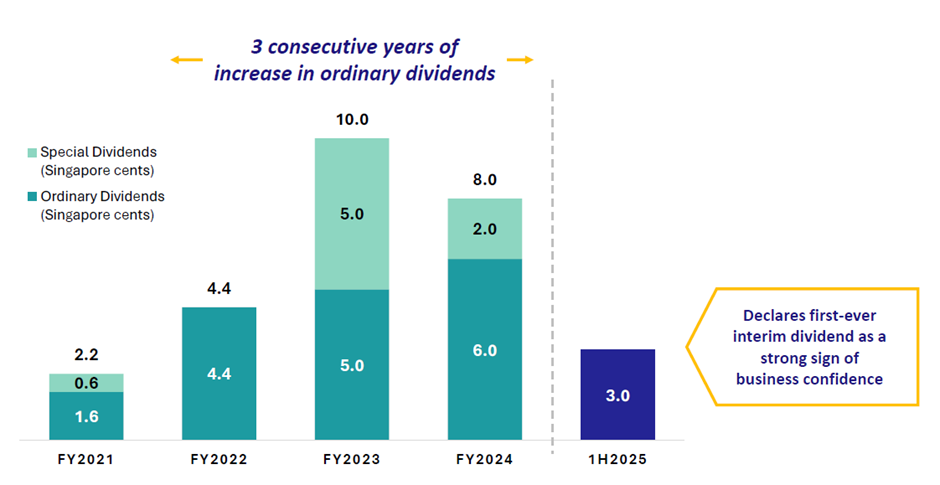

In a sign of confidence, the company declared its first-ever interim dividend of 3.0 Singapore cents in 1H2025.

Based on consensus dividend of 9 Singapore cents and share price of S$2.42 as of 29 December 2025, Food Empire Holdings offer a potential forward dividend yield of approximately 3.7%.

Related links:

- Food Empire Holdings share price history and share price target

- Food Empire Holdings dividend forecast and dividend yield

#3 - CSE Global (SGX: 544)

CSE Global is a global systems integrator providing electrification, communications, and automation solutions.

It serves customers in the energy, infrastructure, and mining sectors, with a growing focus on data centres and sustainable energy solutions.

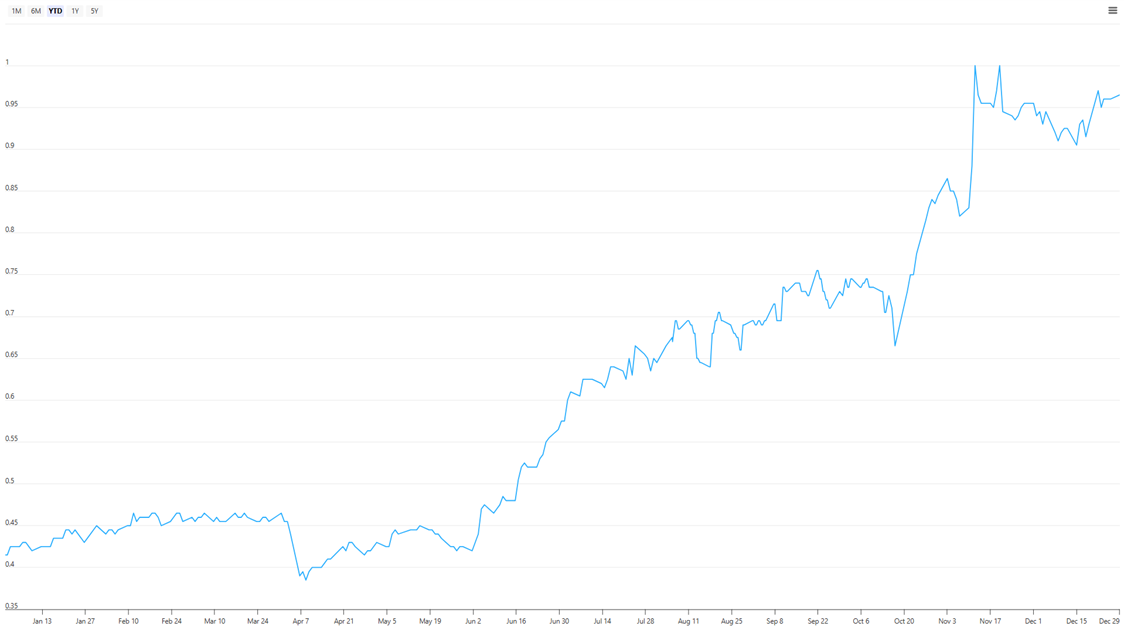

The stock comes in third, rising approximately 132.5% year-to-date as of 29 December 2025, fueled by contract wins in the high-growth data centre electrification space and a resilient order book of S$467.5 million, as of 30 Sep 2025.

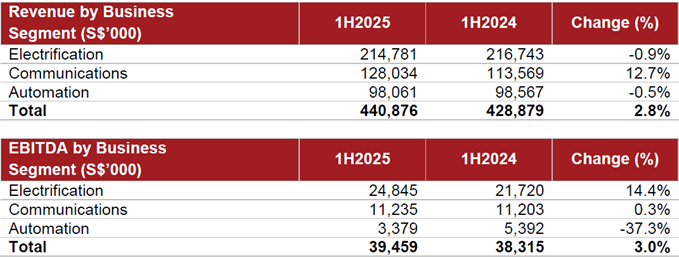

In 1H2025, CSE Global reported revenue of S$440.9 million, up 2.8% year-on-year. Net profit grew 8.5% to S$16.3 million.

The communications segment was a key driver, growing 12.7% due to contributions from recent acquisitions, while the electrification segment remained stable despite currency headwinds.

CSE Global reported a 20.5% year-on-year jump in revenue to S$257.7 million for Q3 2025, and continued to be driven by strong project execution in its electrification and communications segments.

In November 2025, CSE announced a strategic partnership with Amazon which includes multi-year service commitments estimated at ~US$1.5bn over five years and warrants giving Amazon an ~8% stake in CSE, boosting CSE's capital and validating its AI/data center focus.

Based on CSE Global's trailing 12-month dividend of S$2.29 cents, CSE Global's trailing dividend yield stands at about 2.4% at the current share price of S$0.965 as of 29 December 2025.

Related links:

- CSE Global Limited share price history and share price target

- CSE Global Limited dividend forecast and dividend yield

#4 - Pan-United Corporation (SGX: P52)

Pan-United Corporation is Singapore’s largest supplier of ready-mix concrete (RMC) and a fast-emerging digital solutions player.

With more than 70 years of operating history, the company has transformed from a traditional building-materials supplier into a technology-enabled, low-carbon concrete specialist with an expanding regional footprint.

The share price of Pan-United Corporation is up by approximately 107.2% year-to-date as of 29 December 2025 on the back of a robust construction sector outlook and its leadership in low-carbon concrete solutions.

Pan-United is uniquely positioned to benefit from Singapore’s multi-year construction upcycle, driven by major public infrastructure projects, strong public housing demand, and rising sustainability requirements within the built environment.

Pan-United reported steady growth in 1H2025, with revenue rising 4% to S$401.1 million.

Profit after tax and minority interests (PATMI) grew 11% to S$20.6 million, supported by higher sales volume and better margins from its specialized concrete products.

Earnings visibility has improved with PanU securing S$430 million of ready-mix concrete contracts for Changi Airport Terminal 5, providing an average S$86 million of annual revenue through 2030—about 11% of FY24 revenue.

Beyond T5, PanU remains deeply involved in public housing launches, healthcare facilities, mixed-use developments and MRT projects.

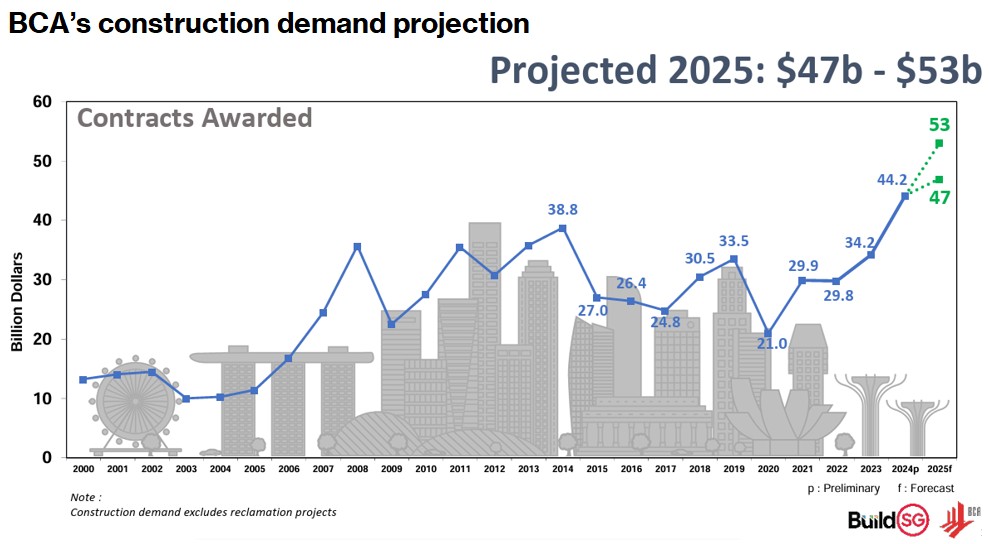

Singapore’s construction outlook remains strong. According to the Building and Construction Authority (BCA), total construction demand is expected to reach S$47–53 billion in 2025, up from S$44.2 billion last year.

PanU ended the half year with S$69.8 million in net cash, giving it strong flexibility to fund expansion without taking on high debt.

To support the rising demand ahead, Pan-United is investing heavily in capacity. The group plans around S$60 million of capex in 2025, mainly for a new batching plant at the Jurong Port Integrated Construction Park.

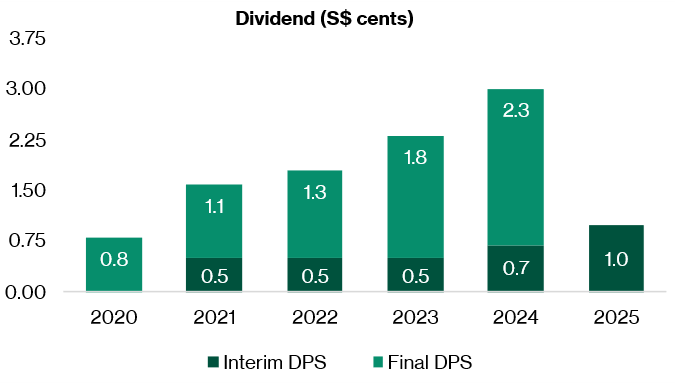

The company also raised its interim dividend by 43% to 1.0 cent per share (vs. 0.7 cent in 1H24), continuing its steady track record of dividend increases.

This strong financial position supports PanU’s ongoing investments in low-carbon technology, digital systems, and new production plants.

Consistent free cash flow also helps the company maintain dividend stability through economic cycles.

Related links:

- Pan-United - Market leader with multi-year dividend growth

- Pan-United Corporation Ltd share price history and share price target

- Pan-United Corporation Ltd dividend forecast and dividend yield

#5 - PropNex (SGX: OYY)

PropNex is Singapore’s largest listed real estate agency with a sales force exceeding 13,000 agents.

It provides a comprehensive suite of real estate services, including property brokerage, project marketing, and consultancy, holding a dominant market share in new project launches.

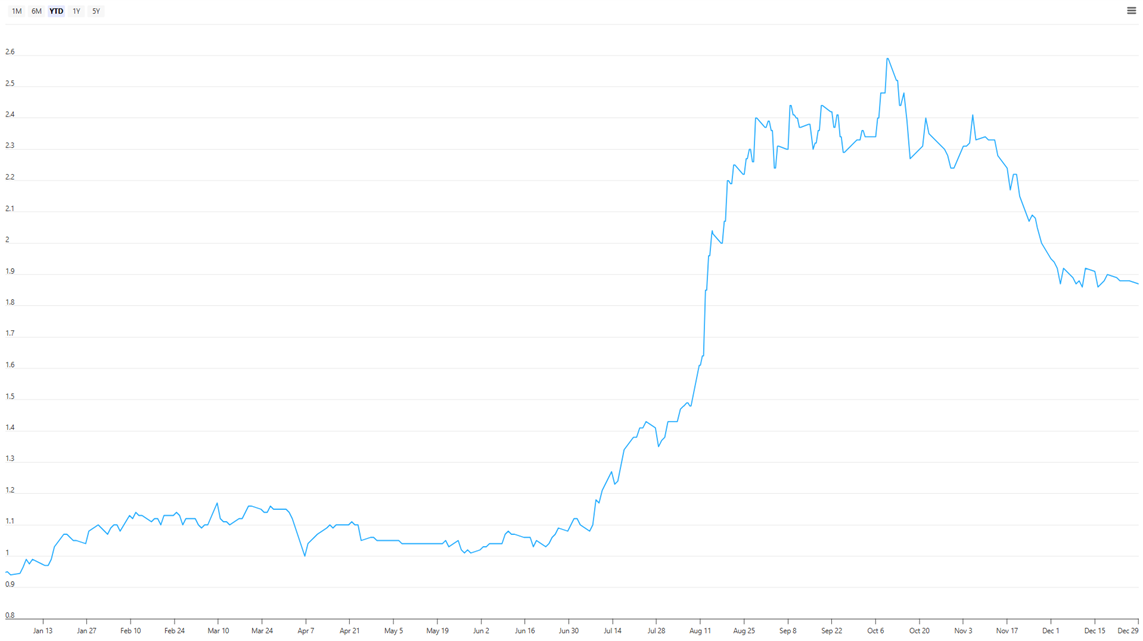

PropNex shares have gained approximately 97.9% year-to-date as of 29 December 2025, supported by its ability to capture market share in a competitive environment.

PropNex delivered a strong performance in 1H2025.

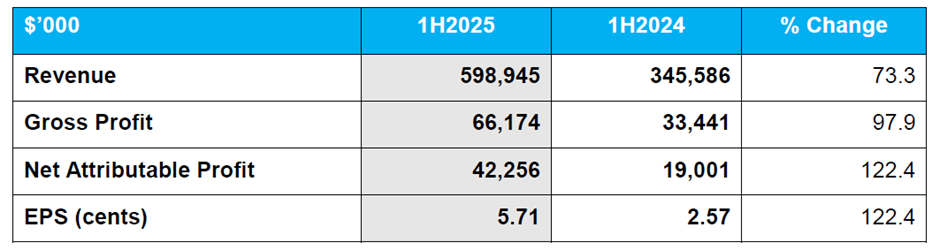

Net profit for the period more than doubled, surging 122.4% year-on-year to S$42.3 million.

Revenue jumped 73.3% to S$598.9 million, driven largely by the project marketing services segment, which saw commission income rocket by 183.2% due to a strong pipeline of project launches and higher transaction volumes.

PropNex continues to take the lion’s share of property transaction volume.

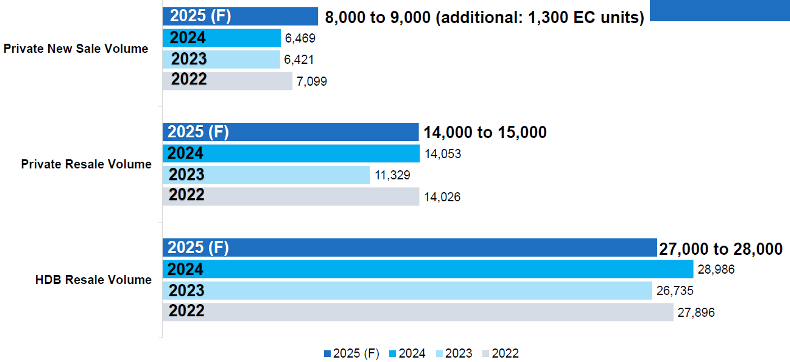

In 1H25, the industry’s transacted volume of new homes, excluding executive condominium, increased by 143% year-on-year to 4,587 units. Prices in Singapore home market were strong.

Management is optimistic that the demand for new private residential homes will hold up to support higher transacted volume.

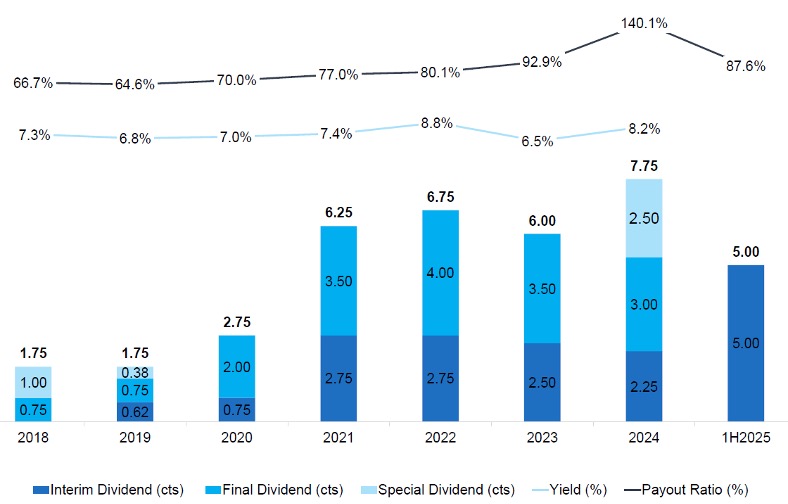

PropNex proposed DPS of 5.0 cents in 1H 2025, an increase of 122% year-on-year.

This translates to dividend payout ratio (DPR) of 87.6% of net attributable profit.

PropNex has consistently maintained a high dividend payout ratio (DPR).

Based on the share price of S$1.87 as of 29 December 2025 and potential consensus payout of S$0.10 per share, this implies Propnex has a potential forward dividend yield of approximately 5.3%.

Related links:

- PropNex - Proxy to strong new launch momentum

- PropNex Limited share price history and share price target

- PropNex Limited dividend forecast and dividend yield

What would Beansprout do?

As 2025 draws to a close, the Singapore market has seen a surge in interest beyond the familiar blue-chip names.

These five top-performing iEdge Singapore Next 50 stocks in 2025 share some common traits. Most benefited from strong growth in topline revenue, a clear recovery in earnings, or exposure to favourable industry trends.

However, their dividend profiles remain varied, with yields ranging from modest to more income-attractive levels.

Among the five stocks, PropNex offers the highest potential forward dividend yield at approximately 5.3%, following its record interim dividend declared in 1H2025.

Food Empire follows with a potential forward dividend yield of around 3.7%, supported by record revenue for 1H2025 and its first-ever interim dividend.

The outperformance of these iEdge Singapore Next 50 stocks highlights the opportunities available in the mid-cap space. However, investors should be mindful that these stocks can be more volatile.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies. Learn more about the STI ETF and how to choose the best STI ETF for your portfolio here.

You can find out what may drive further potential upside in Singapore stocks here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments