US stocks hit record highs as gold prices slip: Weekly Market Recap

By Gerald Wong, CFA • 26 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks climbed to record highs while gold prices slipped from recent peaks

At the CPF Ready for Life event this week, I was asked to share some tips on how to gain confidence in investing.

It’s a journey I’m still on, and mistakes are simply part of learning.

One of the hardest parts is managing emotions during market swings. In recent weeks, we’ve seen sharp moves across markets, from the S&P 500 to precious metals. After hitting new highs earlier, both gold and silver corrected sharply this week.

In this week’s feature, we look at how silver compares to gold as a way to diversify your portfolio, and explore a few ways to gain exposure to silver in Singapore.

With T-bill yields falling again this week, some of you may also be looking for alternative places to park your cash. We review whether it’s worth applying for the latest Singapore Savings Bond (SSB), and highlight three Singapore REITs offering dividend yields above 5%.

As our Money Diaries guest Joanne shared this week, transformation starts with small steps. For some, this may be opening your first brokerage account, while it may be finding new ways to build passive income for others.

For me, staying confident through market swings really comes down to having a plan, staying consistent, and trusting that every step forward counts.

Happy growing!

Gerald, Founder of Beansprout

⏰ This Week In Markets

🚀 Record highs

What happened?

The US core consumer price index (CPI), which excludes food and energy costs, rose 3.0% year-on-year, slightly below market expectations of 3.1%.

It was also the only piece of official economic data released during the ongoing government shutdown.

What does this mean?

The latest inflation reading strengthened hopes that price pressures are easing, reinforcing expectations of upcoming rate cuts by the US Federal Reserve.

According to the CME FedWatch Tool as of 24 October 2025, markets are pricing in a 99% chance of a 0.25% (25 basis points) rate cut at the next Fed meeting.

Market sentiment was further lifted after the White House confirmed that US President Donald Trump will meet Chinese President Xi Jinping next week during his trip to Asia.

Why should I care?

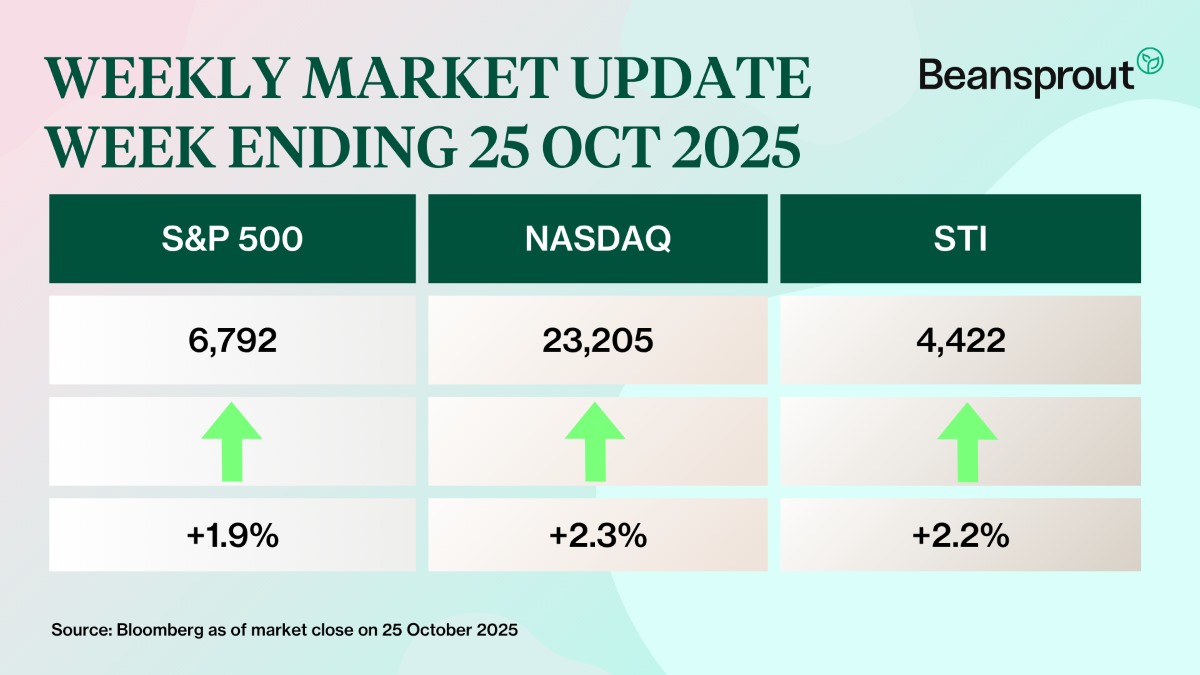

US markets rallied this week, with all major indices reaching new intraday highs. The S&P 500 briefly crossed above 6,800 for the first time in history.

Meanwhile, gold and silver saw their steepest sell-off in years as investors took profits, concerned that the recent historic rally had pushed prices too high. Learn more about our analysis of gold prices here.

Back home, the Straits Times Index (STI) also rebounded on expectations of more measures to support the Singapore market. MAS deputy chairman Chee Hong Tat said the government will announce details of its “Value Unlock” programme in November, with the objective of helping listed companies enhance shareholder value and better engage investors.

Gains were led by cyclical stocks such as Yangzijiang Shipbuilding and Seatrium, as well as property developers City Developments and UOL, following strong new home sales. Read more analysis of the Singapore Property Market here.

🚗 Moving This Week

- Mapletree Pan Asia Commercial Trust (MPACT) reported a distribution per unit (DPU) of 2.01 cents for the 2QFY2025/2026 ended Sept 30, up 1.5% y-o-y. Despite the absence of Mapletree Anson’s contribution following its divestment in July 2024, its Singapore portfolio recorded higher gross revenue and NPI, which grew 3.5% and 6.1% y-o-y respectively. Read more here.

- Frasers Centrepoint Trust (FCT) distribution per unit (DPU) for its second half ended September 2025 came in at S$0.06059, up 0.6 per cent from S$0.0602 a year earlier. The higher distributions were distributed to its acquisition of Northpoint City South Wing in May 2025, as well as contributions from Tampines 1, which completed asset enhancement initiatives in August 2024. There was also broad-based improved performance in revenue and NPI across the portfolio, noted the manager. Read more here.

- Keppel DC REIT reported distribution per unit (DPU) of 7.67 cents for the nine months to Sept 30 (9M 2025), up 8.8% year-on-year. Higher net property income was due to the acquisitions of Keppel DC Singapore (KDC SGP) 7&8, Tokyo Data Centre 1 and organic growth from higher contributions from contract renewals and escalations. Read more here.

- Suntec REIT has reported a distribution per unit (DPU) of 1.778 cents for the 3QFY2025 ended Sept 30, up 12.5% y-o-y. This was driven by stronger operational performance of the REIT’s Singapore portfolio, lower financing costs and the reversal of withholding tax provision for the Australia portfolio. Read more here.

- OUE REIT reported lower net property income (NPI) in 3Q25 following the divestment of Lippo Plaza Shanghai. However, its Singapore portfolio remained resilient. Read our analysis here.

- Digital Core REIT (DCREIT) reported higher distributable income of US$35.2 million in 9M25, up 1.9% compared to 9M24. Read our analysis here.

- ST Engineering has secured new contracts of $4.9 billion for the 3Q2025, bringing total contract wins for 9MFY2025 to $14 billion. This includes $1.4 billion from commercial aerospace, $2.4 billion from defence & public security, and $1.1 billion from urban solutions & satcom. Read more here.

- Seatrium announced that it has rejected the notice of termination of its US$475 million contract inked with a Maersk Offshore Wind affiliate in 2022. In that rejection, it said that the Maersk affiliate was “in repudiatory breach of the contract” and it “reserved all its rights against the buyer for wrongful termination”. Read more here.

- Jardine Matheson is moving to take Mandarin Oriental private in a recommended cash takeover valued at US$3.35 per share, bringing the hotel group’s total valuation to about US$4.2 billion. The offer includes a US$2.75 scheme value and a US$0.60 special dividend from the hotel group’s sale of part of One Causeway Bay (OCB), a commercial development in Hong Kong. It represents about a 52.3 per cent premium to Mandarin Oriental’s closing price of US$2.20 on Sep 29. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

3 Singapore REITs with dividend yields of above 5%

We highlight three Singapore REITs that offer dividend yields of above 5%.

🤓 What we're looking out for next week

- Tuesday, 28 October 2025: CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust earnings, Singapore Savings Bond (SSB) application closing date, Beansprout webinar: Can AvePoint ride the AI wave to grow?

- Wednesday, 29 October 2025: Microsoft, Alphabet, Meta Earnings, Mapletree Industrial Trust Earnings, US Federal Reserve meeting

- Thursday, 30 October 2025: Keppel, Wilmar, Lendlease REIT earnings, Apple, Amazon earnings, Mapletree Pan Asia Comm Trust ex-dividend

- Friday, 31 October 2025: CapitaLand Ascendas REIT earnings, Suntec REIT ex-dividend, US Core PCE Price Index Data

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments