CICT, Mapletree Logistics Trust and Mapletree Industrial Trust in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 03 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about the CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust, and Mapletree Industrial Trust in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside the CapitaLand Integrated Commercial Trust, Mapletree Logistics Trust, and Mapletree Industrial Trust.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

2:09 - Macro Update

The S&P 500 reached 6,840 points and Singapore's STI climbed above 4,400 points, driven by improved sentiment surrounding a planned meeting between US President Donald Trump and Chinese President Xi Jinping.

The Federal Reserve cut interest rates by 25 basis points as expected in November, continuing the rate-cutting trajectory that began in Q4 of the previous year after maintaining flat rates through most of H1 2025, though this move was already fully priced into markets.

US 10-year Treasury yields rebounded above 4% (reaching 4.08% by Friday) from lows of 3.95% pre-Fed meeting, reflecting diminished rate cut expectations and causing pressure on interest rate-sensitive sectors.

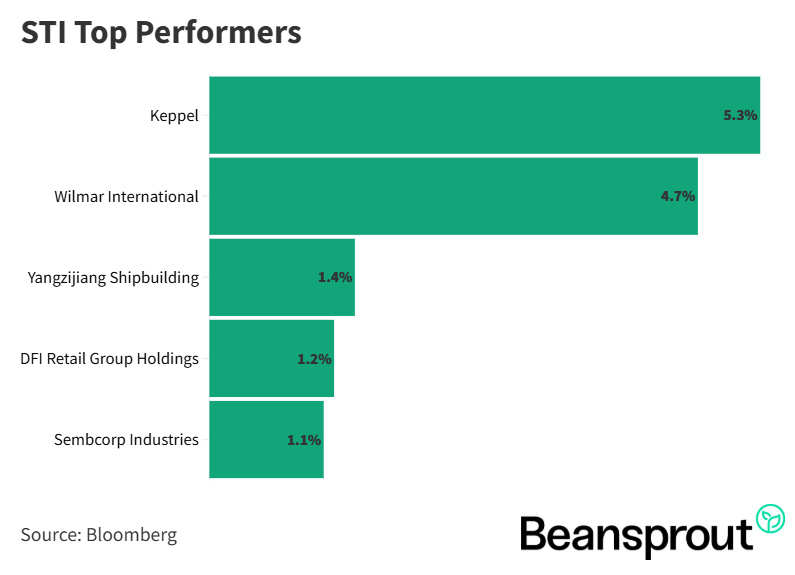

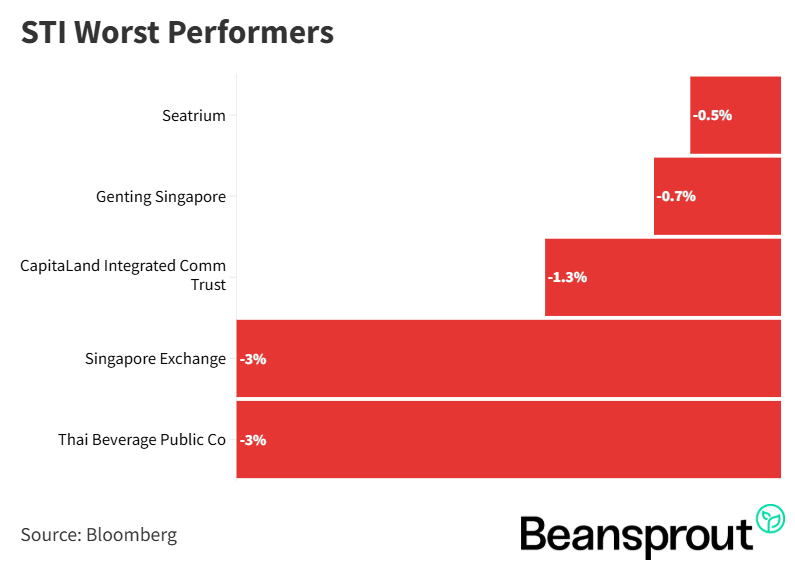

Notable performers include Keppel Limited, gaining 5% and cyclical stocks like Wilmar (+4.7%), Yangzijiang Shipbuilding (+1.4%), and Sembcorp Industries (+1.1%), benefiting from easing US-China trade tensions, while REITs declined, with CapitaLand Integrated Commercial Trust falling 1.3% due to rising bond yields.

REITs faced headwinds after their recent rally as the bounce in bond yields pressured valuations in the sector, coinciding with several REITs releasing operational updates and quarterly earnings reports.

STI Top Performers:

STI Worst Performers:

Capitaland Integrated Commercial Trust (CICT)

Net property income grew (+1.6% YoY) in Q3 2025, demonstrating resilient performance across all asset classes, with stable NPI for office and integrated developments and increased NPI for the retail segment.

Portfolio occupancy rate improved substantially to 97.2% in September 2025 from 96.3% in June 2025, with the most significant gains in the office portfolio while retail and integrated development portfolios maintained their strong occupancy levels.

Retail portfolio achieved strong rental reversions of 7.8% with downtown assets posting 7.4% positive reversion and suburban properties achieving 8.4%, reflecting robust leasing momentum and tenant demand across CICT's retail properties.

Singapore office rents continued climbing to $10.92 per square foot per month in September 2025, up from $10.81 in June 2025 and $10.72 in September 2024, demonstrating sustained improvement in office market conditions and CICT's ability to capture rental growth.

Balance sheet remained healthy with 39.2% leverage (below the 40% threshold) and average cost of debt declining to 3.3% from 3.4% as of June 2025, providing financial flexibility for future growth initiatives.

CapitaSpring acquisition to provide full-quarter contribution in Q4 with the recently acquired Capital Spring Office Building expected to contribute to NPI on a 100% interest basis from August 26, 2025, alongside ongoing asset enhancement initiatives

Current valuation stands at 1.1 times price-to-book ratio with a 4.6% dividend yield.

Read our analysis of CapitaLand Integrated Commercial Trust (CICT) acquisition of CapitaSpring here.

Related Links:

CapitaLand Integrated Commercial Trust (CICT) share price history and share price target.

CapitaLand Integrated Commercial Trust (CICT) dividend history and dividend forecast

Mapletree Logistics Trust (MLT)

Distribution per unit declined (-10.5% YoY) to 1.815 cents in the quarter ending September 2025 from 2.027 cents in the prior year, primarily due to asset divestments that reduced gross revenue and net property income.

Portfolio occupancy improved modestly to 96.1% as of September 2025 from 95.7% in June 2025, with Singapore seeing improved occupancy rates and China's occupancy rate rising slightly to 94% from 93% over the same period.

Rental reversions weakened to 0.6% for the entire portfolio compared to 2.1% in Q1 FY2024/25, with Singapore rental reversions declining to just 3.9% positive while China continued to post negative rental reversions, dragging down the overall portfolio performance.

Leverage ratio stood at 41.1% with the weighted average interest rate declining to 2.6% from 2.7% in the previous quarter, reflecting benefits from the lower interest rate environment and improved debt management.

Current valuation above book value with 5.3% dividend yield as the share price has recovered strongly over the past month in anticipation of Federal Reserve rate cuts

Read our analysis of 3 Singapore REITs offering dividend yields of above 5% here

Related links:

Mapletree Logistics Trust (M44U) share price history and share price target

Mapletree Logistics Trust (M44U) dividend history and dividend forecast

Mapletree Industrial Trust

Distribution per unit declined (-5.6% YoY) to 3.18 cents in Q2 FY2024/25, driven by lower gross revenue and net property income, triggering a pullback in the share price following the earnings announcement despite the recent recovery in anticipation of Federal Reserve rate cuts.

North American portfolio occupancy weakened to 87.8% from 88% in the previous quarter, with data center occupancy remaining below 90% at 89.6%.

Singapore high-tech buildings and business space rental reversions turned negative at -1.6% in Q2 versus a positive 5% in the previous quarter.

Active portfolio rebalancing and repositioning strategy underway with Mapletree Industrial Trust engaging tenants ahead of lease renewals to backfill vacant spaces, undertaking redevelopment projects to enhance distribution per unit accretion, and divesting non-core properties including a Georgia data centre at an 18.6% premium to market valuation to optimize the portfolio mix.

Leverage ratio improved to 37.3% as of September 2025 following strategic divestments, while average borrowing costs declined to 3.0% from 3.1% in the previous quarter.

Mapletree Industrial Trust offers a higher dividend yield than peers due to investor concerns on exposure to US data centre assets

Read our analysis of 3 Singapore REITs offering dividend yields of above 5% here

Related links:

Mapletree Industrial Trust (ME8U) share price history and share price target

Mapletree Industrial Trust (ME8U) dividend history and dividend forecasts

17:50 - Technical Analysis

Straits Times Index (STI)

STI index showed flat weekly performance but reached new all-time high with the index up just 0.02% for the week and 0.3% on Monday morning.

Key support level are 4,348 points (50-day moving average) and 4,340 (lower Bollinger band).

Target of 4,500 points by year-end driven by upcoming bank earnings with positive expectations for the three local banks reporting on Thursday and Friday this week, which are anticipated to provide the catalyst to push the STI toward the 4,500 level by the end of 2025.

MACD indicator suggests the index is likely to remain in formation until new catalysts emerge, while the RSI at 61 points indicates the longer-term uptrend momentum remains intact despite the recent slowdown.

Learn more about the Straits Times Index (STI) here.

Dow Jones Industrial Average

Dow Jones rallied strongly and achieved new all-time high of 48,040 points last Wednesday, though the index ended Friday at 47,562 points, demonstrating continued strength in US equities alongside other major US indices reaching record levels.

Uptrend momentum showing signs of slowing mid-earnings season as the MACD indicator suggests deceleration following the completion of big bank earnings.

RSI at 64 points signals continued upside momentum indicating the uptrend on US indices is likely to persist despite the recent slowdown, with the reading suggesting strong bullish sentiment remains intact and supporting further gains.

First support level identified at 46,228 points coinciding with the 50-day moving average, which represents the initial retracement level where buyers are expected to re-enter the market and rejoin the uptrend bandwagon targeting the 48,040 all-time high.

Secondary support at 45,500 points provides strong technical floor where the lower Bollinger band converges with multiple support areas, offering substantial buying interest should the index experience a deeper pullback from current elevated levels.

S&P 500

S&P 500 achieved new all-time high of 6,920 points last Wednesday with the index up 1% for the week, 2.6% over the past month, and 16% year-to-date, delivering performance similar to the STI index and demonstrating continued strength in US equities.

7,000-point psychological level within striking distance with major big tech names like NVIDIA still yet to report earnings, suggesting the rally has potential to continue.

MACD indicates momentum deceleration without trend reversal showing the uptrend is slowing down but no bearish crossover has occurred.

RSI at healthy 61-point reading signals continued upside potential sitting 10 points above the 50-point neutral mark and well below overbought territory.

Nasdaq Composite Index

Nasdaq demonstrated strong resilience with Friday recovery from mid-week selloff after experiencing a Thursday scare with a 1.5% decline (370 points), only to bounce back strongly on Friday.

All-time high of 24,019 points represents key near-term resistance with this level serving as the technical ceiling the index must breach, pending NVIDIA's earnings results scheduled for November 19, 2025, which will be a critical catalyst for the tech-heavy index.

Key support levels at 50-day moving average of 22,485 points with secondary support at the lower Bollinger band around 22,100 points, providing two distinct technical floors where buying interest is expected to materialize during pullbacks.

MACD shows decelerating uptrend momentum over past two weeks indicating the recent rally is slowing down, though the indicator suggests consolidation rather than reversal as the market awaits major tech earnings releases to provide the next directional catalyst.

What to look out for this week

Tuesday, 4 November 2025: SIA Engineering, Elite UK REIT earnings, AMD earnings, Mapletree Logistics Trust ex-dividend

Wednesday, 5 November 2025: AIMS APAC REIT, Manulife US REIT, Parkway Life REIT earnings, First REIT ex-dividend

Thursday, 6 November 2025: DBS, UOB, Stoneweg European Stapled Trust earnings, 6 Month Singapore T-bill Auction

Friday, 7 November 2025: OCBC, Frasers Logistics & Commercial Trust earnings

Get the full list of stocks with upcoming dividends here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments