5 Singapore REITs that raised dividends in February 2026. Are their yields attractive?

REITs

By Gerald Wong, CFA • 20 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are 5 Singapore REITs that raised dividends in February 2026. We assess what drove the increase and whether their yields remain attractive.

What happened?

With Singapore T-bill yields falling, I have been looking at other instruments that may offer a higher yield.

Earlier, we shared three blue chip stocks that raised dividends in February 2026, including DBS, Keppel and SGX.

This led to questions about whether there are REITs that have also been able to raise their dividends, and how their dividend yields compare to the blue chip REITs with dividend yields above 5%.

In this article, we focus on five Singapore blue chip REITs that raised dividends in February 2026, we break down what drove the increase and how their dividend yields compare.

5 Singapore REITs that raised dividends in February 2026

#1 - CapitaLand Integrated Commercial Trust (SGX: C38U)

CapitaLand Integrated Commercial Trust is Singapore’s largest REIT by market value, with a portfolio anchored by integrated developments, offices, and retail malls.

Its portfolio includes landmark properties such as ION Orchard, Plaza Singapura, and prime office buildings like CapitaSpring, which gives unitholders exposure to both consumer spending and CBD office demand.

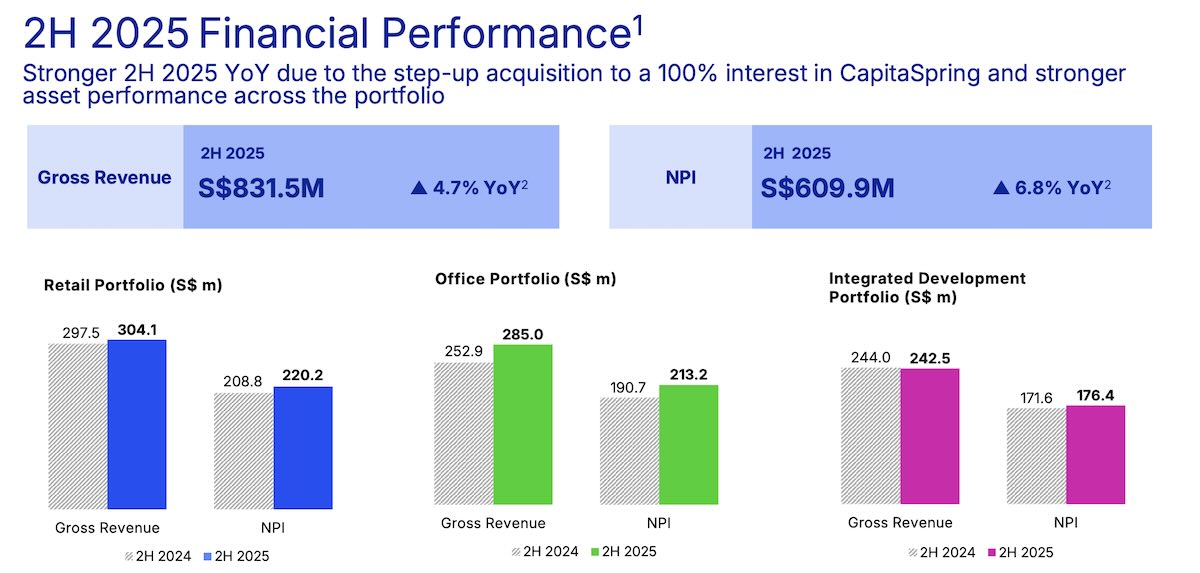

CICT reported stronger operating momentum in the second half of 2025, supported by higher contributions from both its retail and office segments.

In 2H 2025, gross revenue rose 4.7% year-on-year to S$831.5 million, while net property income increased 6.8% to S$609.9 million..

This was supported by strong occupancy rates across its portfolio, as well as contribution from acquisition of CapitaSpring.

For the full year of FY2025, CICT reported gross revenue of S$1,619.2 million and net property income of S$1,189.7 million.

Portfolio occupancy was 96.9% as at 31 December 2025. Portfolio WALE was about 3.0 years, which provides some visibility on lease expiry risk.

CICT continued to deliver positive rental reversions of 6.6% for its retail portfolio in FY2025, reflecting firmer leasing conditions and active lease management.

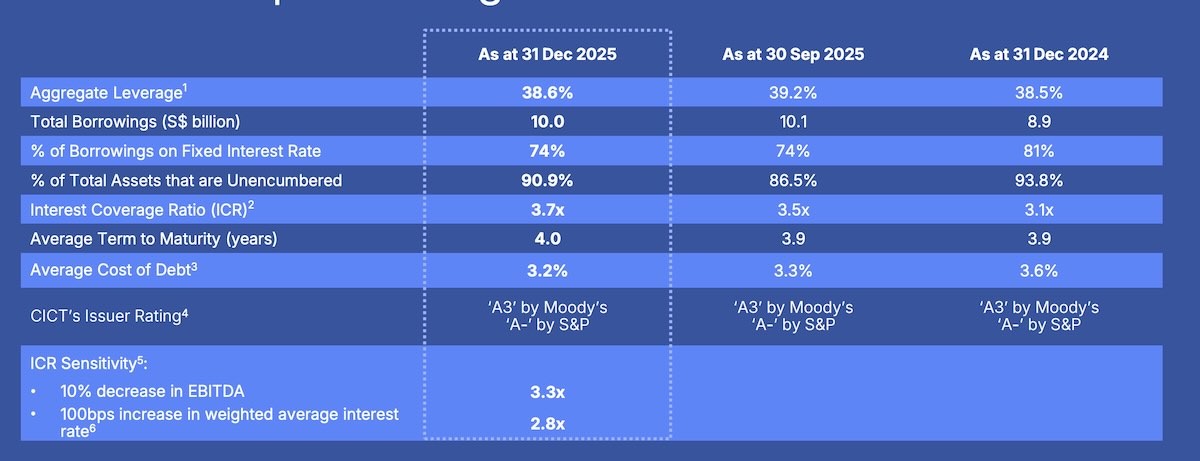

CICT’s balance sheet metrics also improved slightly.

Aggregate leverage was 38.6% as at 31 December 2025, while the average cost of debt fell to 3.2% afrom 3.6% as at 31 December 2024.

Looking ahead, CICT’s pipeline of staggered asset enhancement initiatives (AEIs) may help to lift income.

On the retail side, this includes Tampines Mall with a targeted completion in 3Q26 and Lot One Shoppers’ Mall targeted to complete in 1Q27.

On the office side, Galileo is contributing progressively from 4Q25 following the Phase 1 handover to the European Central Bank in Dec 2025, with Phase 2 targeted for 1Q26.

CICT also expects further interest savings as its interest cost declines to about 3.0% in FY26 from 3.2% as at 31 December 2025.

Recently, CICT agreed to divest Bukit Panjang Plaza for S$428.0m (about 10% above the latest valuation and 165% above its 2007 purchase price), with estimated net proceeds of ~S$421.2m and expected completion in 1Q2.

Management indicated this could reduce gearing from 38.6% to ~37.6% (all else equal), and the exit yield is around the mid-4% level.

In addition, CICT (via a consortium) was awarded the Hougang Central Site for a landmark mixed-use development, where CICT will develop and own 100% of the commercial component, with target completion around 2030/2031.

The improved operating performance flowed through to distributions, with 2H 2025 DPU rising 9.4% year-on-year to 5.96 cents and FY2025 DPU rising 6.4% to 11.58 cents.

Based on the unit price of S$2.42 as at 19 February 2026, CICT has a trailing 12-month dividend yield of 4.8%.

Find out how much dividends you would have received as a shareholder of CapitaLand Integrated Commercial Trust in the past 12 months with the calculator below.

Related links:

- CapitaLand Integrated Commercial Trust vs CapitaLand Ascendas REIT - Which looks more attractive now

- CapitaLand Integrated Commercial Trust (SGX: C38U) share price history and share price target

- CapitaLand Integrated Commercial Trust (SGX: C38U) dividend forecast and dividend yield

#2 - Mapletree Pan Asia Commercial Trust (SGX: N2IU)

Mapletree Pan Asia Commercial Trust, or MPACT, is a regional commercial REIT with exposure across Singapore, Hong Kong, China, Japan and South Korea, with VivoCity as its best-known Singapore flagship.

Its portfolio mix means performance is shaped not only by Singapore leasing and consumer activity, but also by currency movements and operating conditions in other markets where it has exposure.

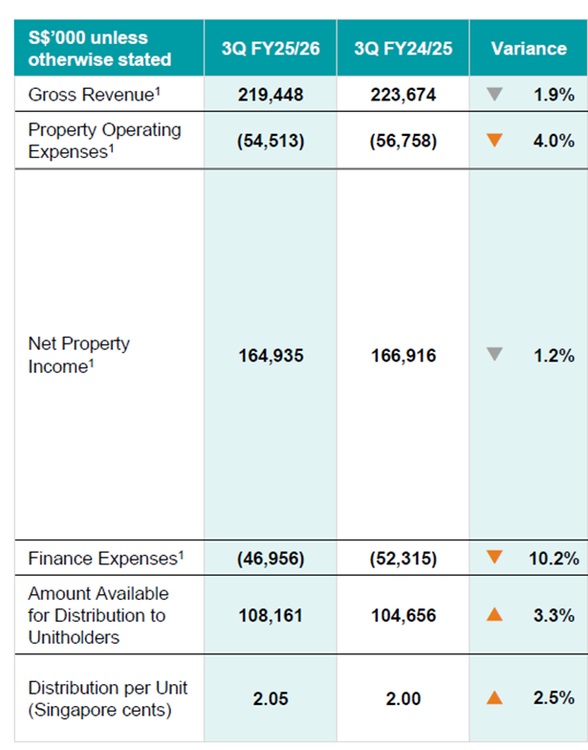

For the third quarter ended 31 December 2025 (3Q FY25/26), MPACT reported gross revenue of S$219.4 million, down 1.9% year-on-year, and net property income of S$164.9 million, down 1.2%.

Operational metrics provide more colour on sustainability. Portfolio committed occupancy was 88.1% as at 31 December 2025, and portfolio WALE by gross monthly income was 2.3 years.

Rental reversion was close to flat at the portfolio level at 0.3%, and the tenant retention rate was 66.3%.

Balance sheet metrics remained comfortable, with aggregate leverage at 37.3%, an all-in cost of debt of ~3.2%, and a fixed-rate debt ratio of about 72%.

For 3Q FY25/26, MPACT reported a 3.3% year-on-year increase in the amount available for distribution and declared a DPU of 2.05 Singapore cents, which was 2.5% higher year-on-year.

The DPU increase is due to stronger Singapore contributions offsetting weaker overseas operations.

In addition, finance expenses fell 10.2% YoY to S$47.0m, helped by lower interest rates on certain borrowings and reduced debt following earlier divestments.

If interest rates stay around current levels, the manager expects 30–40 bps savings as fixed-rate swaps roll off, which could reduce overall interest costs by around 10% in the coming financial year.

MPACT offers a trailing 12-month dividend yield is 5.5% based on the unit price of S$1.45 as at 19 February 2026.

Find out how much dividends you would have received as a shareholder of Mapletree Pan Asia Commercial Trust in the past 12 months with the calculator below.

Related links:

- Mapletree Pan Asia Commercial Trust (SGX: N2IU) share price history and share price target

- Mapletree Pan Asia Commercial Trust (SGX: N2IU) dividend history and dividend forecasts

#3 - OUE REIT (SGX: TS0U)

OUE REIT is a Singapore-focused REIT with a portfolio anchored by prime office and retail assets, alongside hospitality exposure.

Its key properties include One Raffles Place, OUE Bayfront, Mandarin Gallery, Hilton Singapore and Crowne Plaza Changi Airport.

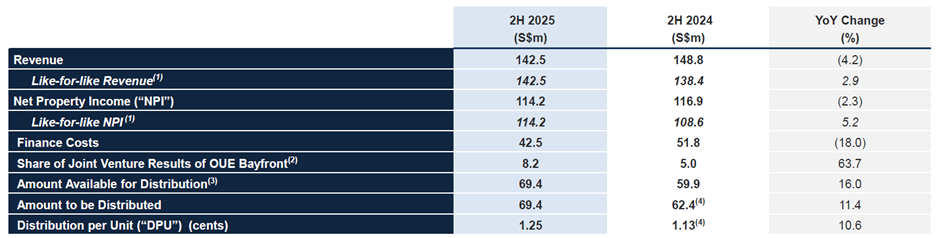

In its latest results, OUE REIT reported 2H 2025 revenue of S$142.5 million, down 4.2% year-on-year, and net property income of S$114.2 million, down 2.3%. The decline largely reflected the absence of a divested asset.

On a like-for-like basis, OUE REIT’s 2H 2025 revenue and NPI rose 2.9% and 5.2% year-on-year, supported by office leasing and a recovery in hospitality performance.

For FY2025, the REIT reported revenue of S$273.6 million and NPI of S$219.6 million.

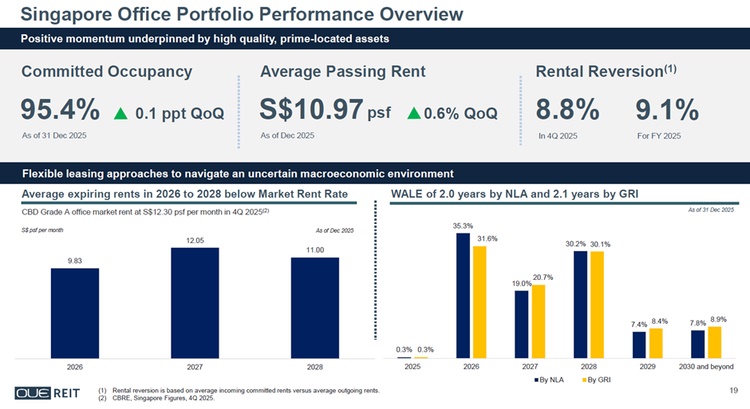

On portfolio operations, the office segment reported committed occupancy of 95.4% in 2H 2025, and recorded a positive FY2025 rental reversion of 9.1%, which helped support like-for-like performance.

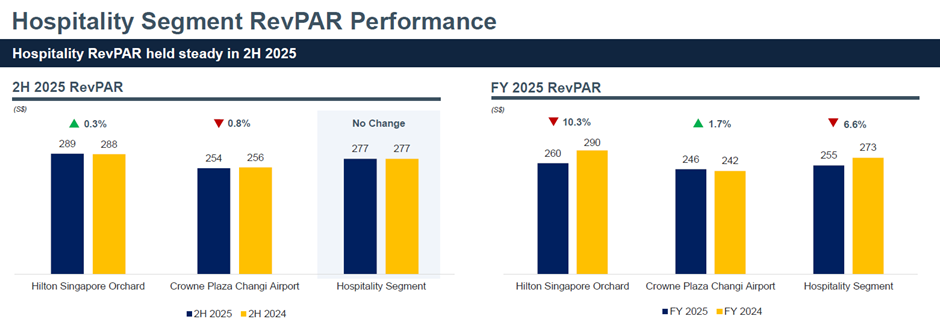

OUE REIT recorded RevPAR of S$277 in 2H 2025, no change from 2H 2024.

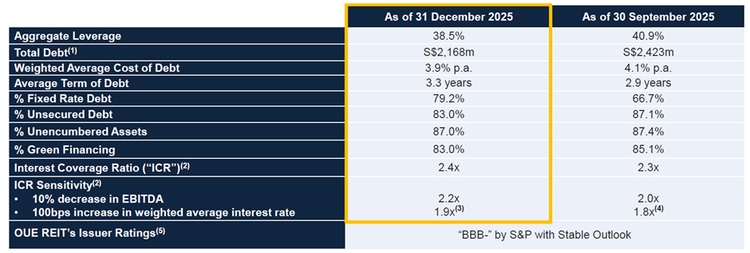

Balance sheet metrics improved after capital management. Aggregate leverage declined to 38.5% and weighted average cost of debt fell to 3.9%.

The REIT extended its average term of debt to 3.3 years, following partial loan repayment using divestment proceeds.

Management estimates every 25bps decline in interest rates could lift DPU by ~0.02 Singapore cents, equivalent to a ~0.9% uplift on FY25 DPU.

OUE REIT has used strategic asset sales such as the divestment of Lippo Plaza Shanghai to streamline its portfolio and recycle capital. The sale reduced reported NPI from the disposed asset, but the proceeds helped lower debt and interest costs.

OUE REIT is in advanced discussions to acquire a partial stake in a prime Sydney CBD office asset (Salesforce Tower, Circular Quay).

Management expects the transaction to be yield-accretive and fully fundable from internal resources, while preserving balance sheet flexibility.

The Sydney core CBD benefits from tight supply beyond 2027, improving effective rents, and sustained flight-to-quality demand, offering an attractive risk-reward profile and diversification upside should the acquisition proceed.

For 2H 2025, OUE REIT reported DPU of 1.25 cents, which was 10.6% higher year-on-year, driven by lower financing costs.

For FY2025, OUE REIT’s DPU rose 8.3% year-on-year to 2.23 cents, translating to a trailing 12-month dividend yield of 6.3% based on the unit price of S$0.355 as of 19 February 2026.

Find out how much dividends you would have received as a shareholder of OUE REIT in the past 12 months with the calculator below.

Related links:

- OUE REIT - Lower interest expense to support DPU growth

- OUE REIT share price and share price target

- OUE REIT dividend history and forecast

#4 - Parkway Life REIT (SGX: C2PU)

Parkway Life REIT is a healthcare-focused REIT with a long operating track record and a portfolio built around defensive, regulated healthcare real estate.

Its earnings base is anchored by Singapore hospitals under a master lease structure, complemented by a Japan nursing home portfolio and a growing exposure to Europe through nursing home assets in France.

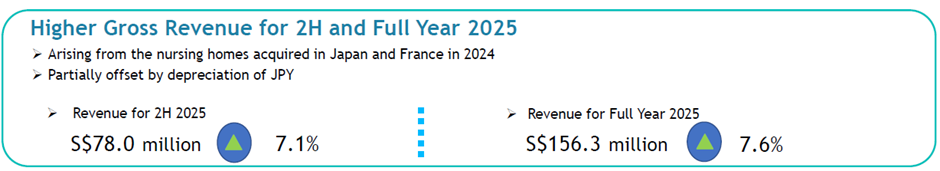

For 2H 2025, Parkway Life REIT reported gross revenue of S$78.0 million, up 7.1% year-on-year, and net property income of S$73.6 million, up 7.9%.

The growth is mainly contributed from the nursing homes acquired in Japan and France, partly offset by depreciation in the Japanese Yen.

Occupancy is also high across geographies, with 100% committed occupancy in Singapore, 97.7% in Japan, and 100% in France.

The Singapore hospital master lease remains a key driver of income visibility. The Singapore hospitals contributed about 65% of gross revenue.

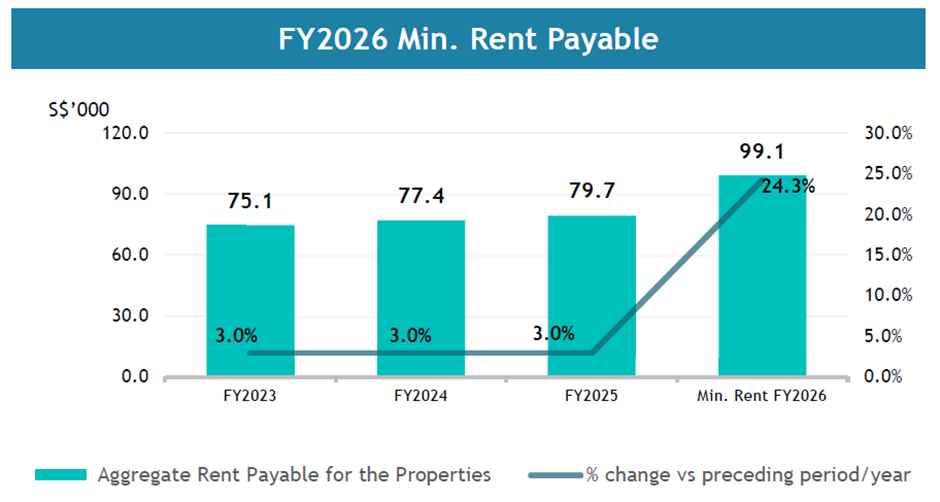

The master lease runs to December 2042, providing long-term lease certainty. Rent step-ups were 2% to 3% annually through FY2025. The lease transitions to a CPI-linked framework from FY2026, with downside protection and potential upside.

Management also guided to a meaningful step-up in minimum rent from about S$79.7 million in FY2025 to about S$99.1 million in FY2026.

As at 31 December 2025, Parkway Life REIT reported gearing of 33.4%, an all-in debt cost of 1.59%, and an interest cover of 8.6 times.

The manager has also been working on rejuvenation initiatives such as selective disposals, lease restructuring, and asset enhancement to defend long-term returns.

Europe is a newer leg of diversification through its France nursing home exposure, which management described as a third growth pillar that remains within the healthcare real estate focus.

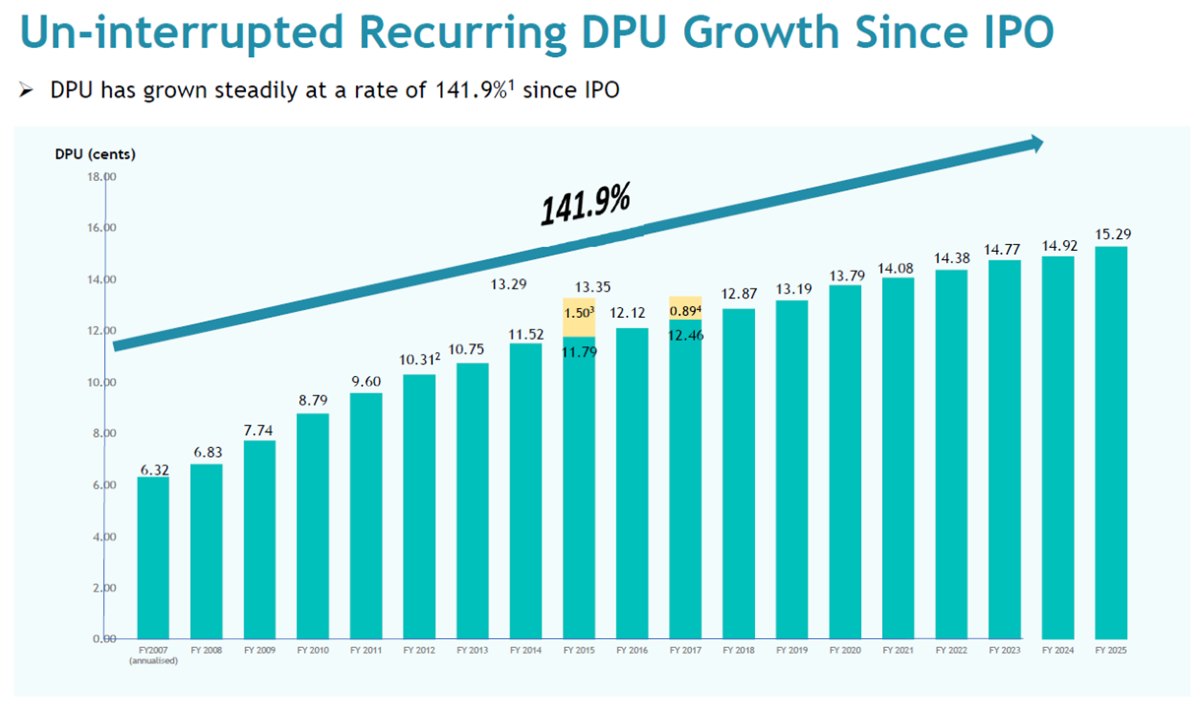

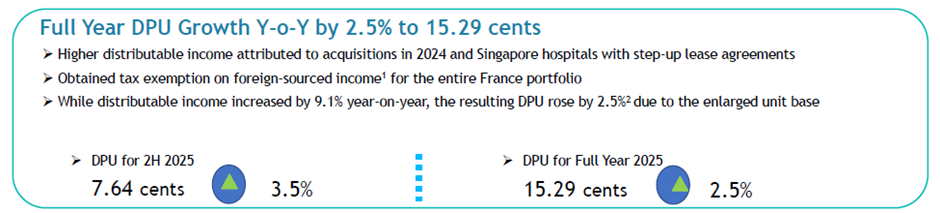

Parkway Life REIT’s distributable income grew 8.8%, which supported a 3.5% year-on-year increase in 2H 2025 DPU to 7.64 cents.

For FY2025, Parkway Life REIT’s DPU was 15.29 cents, and its trailing 12-month dividend yield is 3.8% based on the unit price of S$4.04 as at 19 February 2026.

Find out how much dividends you would have received as a shareholder of Parkway Life REIT in the past 12 months with the calculator below.

Related Links:

- Parkway Life REIT - Steady growth in distribution per unit

- Parkway Life REIT share price history and share price target

- Parkway Life REIT dividend history and dividend forecasts

#5 - CapitaLand India Trust (SGX: CY6U)

CapitaLand India Trust, or CLINT, provides exposure to India’s commercial real estate through a portfolio of business parks, logistics and industrial assets, and a growing data centre platform.

This makes it structurally different from Singapore-centric REITs because returns are shaped by India’s office demand, development completion cycles, and currency movements between the Indian rupee and Singapore dollar.

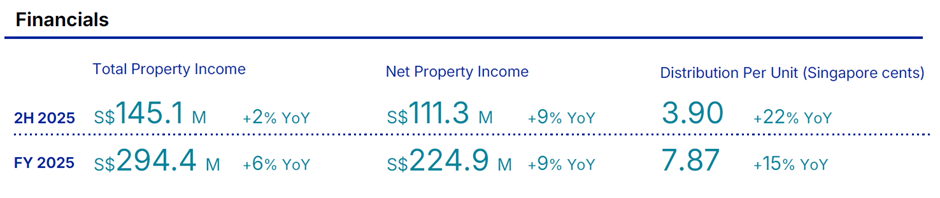

In 2H 2025, CLINT reported total property income rising 2% year-on-year to S$145.1 million, and net property income rising 9% to S$111.3 million.

For the full year of FY2025, CLINT reported total property income of S$294.4 million and net property income of S$224.9 million.

The earnings drivers were supported by higher rental income from existing properties and contributions from newly completed and newly acquired assets.

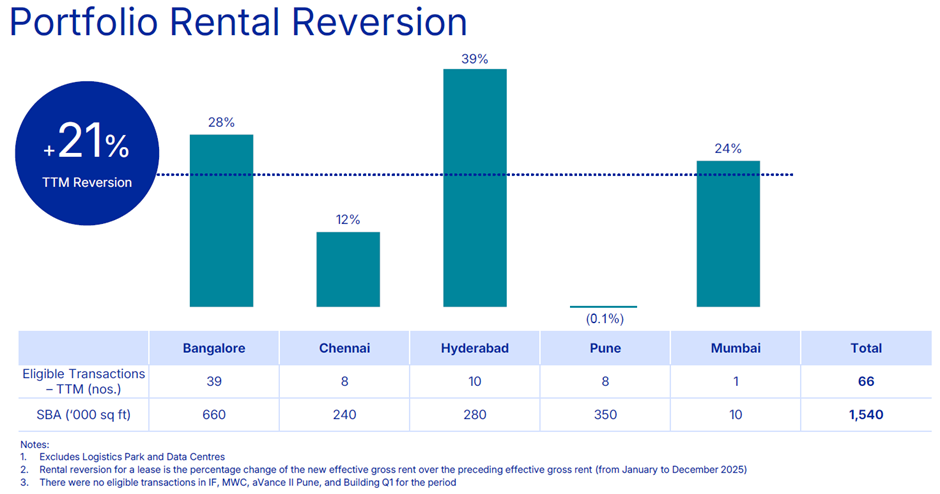

On portfolio operations, CLINT reported committed occupancy of 91.0% and positive rental reversion of 21.0% on leases renewed in 2H 2025 as at 31 December 2025.

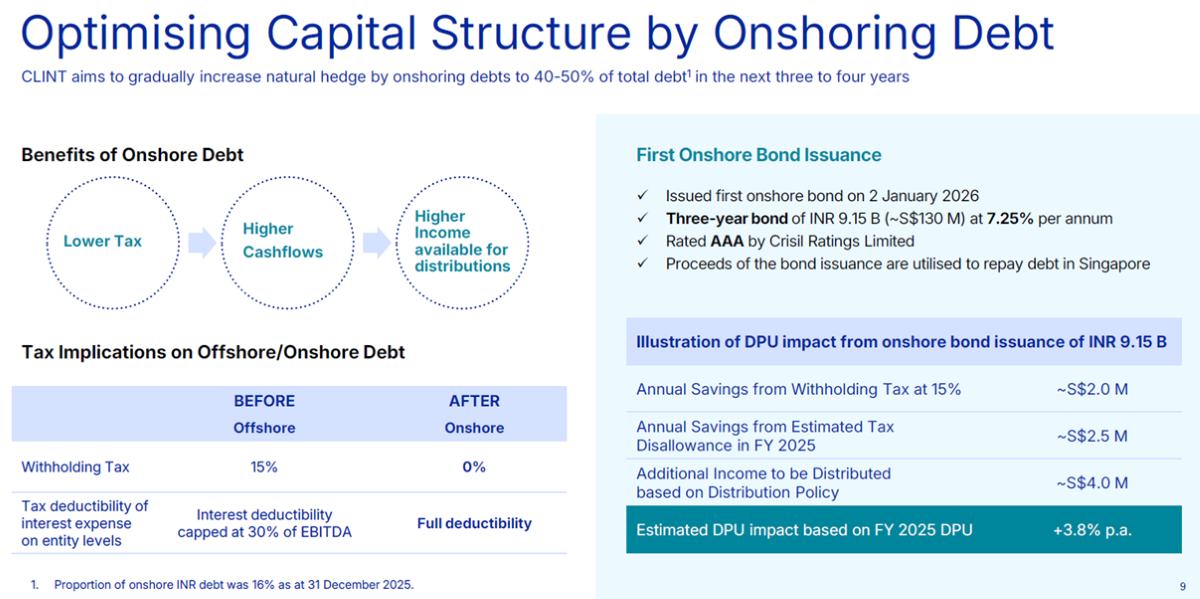

CLINT reported gearing at 39.6%, an interest coverage ratio of 2.7 times, and cost of debt at 5.6% as at 31 December 2025.

It has been diversifying funding sources, including issuing perpetual securities and expanding onshore borrowing.

A key strategic growth pillar is its data centre platform. In August 2025, CLINT completed its first data centre, Navi Mumbai Data Centre, Tower 1, and has begun handing over to a hyperscaler client.

Tower 2 is fully leased to the same hyperscaler and remains under development, with completion expected by December 2026.

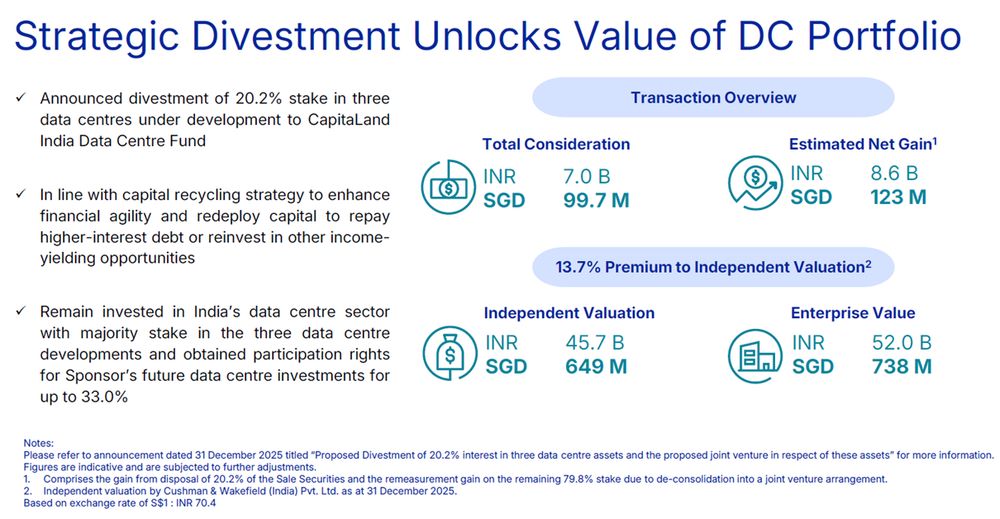

CLINT also disclosed a divestment of 20.2% stakes in three data centres under development for S$99.7 million, expected to complete in 1Q 2026..

The data centre portfolio is now fully funded from construction loan, partial divestment and contribution from joint venture partners.

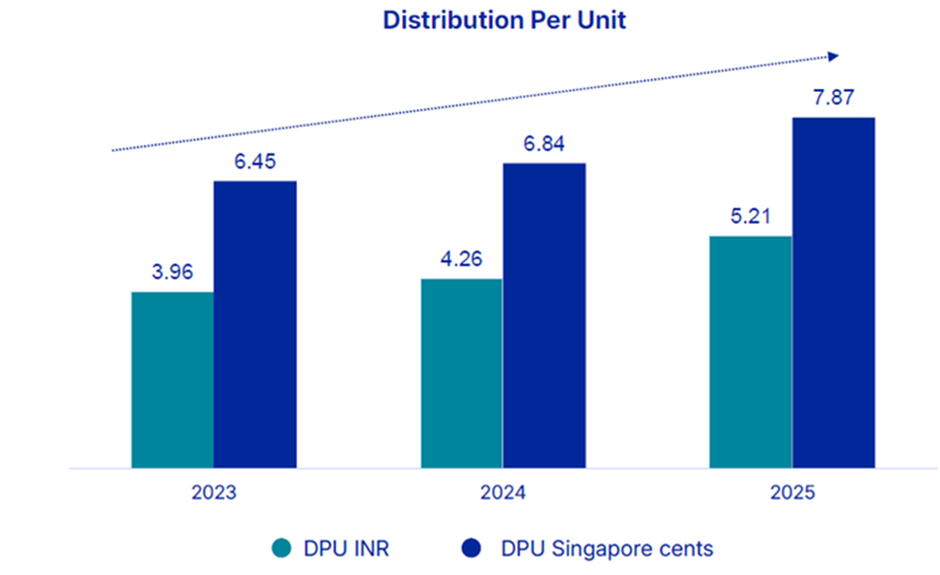

CLINT reported 22% year-on-year DPU growth in 2H FY2025 to 3.90 cents.

For the full year of FY2025, DPU grew 15% year-on-year to 7.87 cents, translating to a trailing 12-month dividend yield of 6.1% based on the closing price of S$1.28 as at 19 February 2026.

Find out how much dividends you would have received as a shareholder of CapitaLand India Trust in the past 12 months with the calculator below.

Related links:

- CapitaLand India Trust - Higher DPU from improved operating performance

- CapitaLand India Trust share price and share price target

- CapitaLand India Trust dividend history and forecast

What would Beansprout do?

One of the key things I look out for in a REIT is its ability to grow its dividends.

Across the five REITs, OUE REIT offers the highest headline trailing 12-month dividend yield of 6.3%,. It has raised FY2025 DPU, supported by lower financing costs, strength in its office portfolio, and recovery in the hospitality sector.

CapitaLand India Trust offers a trailing 12-month dividend yield of about 6.1%, delivering the strongest DPU growth and rental reversion among the five, with progress being made in its data centre portfolio.

Mapletree Pan Asia Commercial Trust offers a trailing 12-month dividend yield of about 5.5%. MPACT’s latest uplift relied more on lower finance costs and Singapore contribution, while overseas markets and currency effects remain a drag.

CapitaLand Integrated Commercial Trust offers a trailing 12-month dividend yield of about 4.8%. CICT’s latest DPU increase was supported by strong occupancy and positive rental reversions across both retail and office portfolios

Parkway Life REIT offers the lowest trailing dividend yield of 3.8%, but it has clearer contractual income visibility, with step-up in minimum rent under its Singapore hospital master lease framework from FY2026.

Overall, OUE REIT and CapitaLand India Trust screen with the highest yields, but they also come with more variables that can affect distributable income, such as office cycles and currency translation.

CICT and Parkway Life REIT offer lower yields, but their income profiles are supported by steadier occupancy and more visible lease structures.

Looking ahead into 2026, we expect Singapore REITs may benefit as interest rates ease and borrowing costs gradually reset lower.

However, the divergence in REIT performance is likely to persist. Returns should still depend on sub-sector exposure, geographical mix, refinancing schedules, and how much debt is locked in at fixed rates

Within the sector, we prefer REITs that can defend and grow distributions through active portfolio management, such as asset enhancements, disciplined capital recycling, selective acquisitions, and capturing rental reversion where fundamentals allow.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 5% p.a. interest boost coupon (worth ~S$100) when you sign up for a Longbridge account via Beansprout. Plus, S$1,380 CapitaVouchers to be won in our exclusive Huat Together Lucky Draw. Promo ends on 28 February 2026. T&Cs apply. Learn more about the Longbridge promotion here.

To screen for Singapore REITs with lowest price-to-book valuation or highest dividend yield, check out our best Singapore REIT screener.

If you are new to investing in Singapore REITs, you can start to learn more about Singapore REITs here.

If you prefer diversification without picking individual REITs, you can also gain exposure through Singapore REIT ETFs.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip REITs.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments