Singapore stocks, gold and silver rally: Weekly Market Recap

By Gerald Wong, CFA • 25 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore stocks reached new highs, while gold and silver rallied.

I was having lunch with the team this week when the topic of New Year resolutions came up.

One of my team members asked, “Do you guys set goals for yourself?” Another, fresh from his performance review earlier in the day, replied, “Yes… we set KPIs.”

And as we head into the last week of January, it’s also the time when our New Year resolutions start to get tested. The excitement of a fresh start fades, real life kicks in, and suddenly it’s easier to “start next week” again.

For some of us, one financial goal this year might be to start investing. And quite naturally, many investors begin with Singapore, simply because it feels familiar and easier to understand.

This week, the Straits Times Index (STI) reached a new record high, supported by measures to boost the Singapore market. One simple way to gain diversified exposure is through an STI ETF, which allows you to invest in the broader market without having to pick individual stocks.

Personally, I also like to look for opportunities beyond stocks that have already done well. That’s why this week, we explore three of the worst-performing blue chip stocks in 2025, and whether they could be due for a turnaround.

We also saw renewed momentum in Singapore’s IPO market, with two new listings this week. The Assembly Place made a strong debut, jumping as much as 46% above its IPO price. We take a closer look at Singapore's largest community living operator, and also speak with CEO Eugene Lim to learn how he grew the business by building a community.

If you’re keen to learn more about the living sector, do join our upcoming webinar on 28 January, where we’ll explore this fast-growing real estate segment and what it means for investors.

Looking ahead, we also have the upcoming listing of the UOBAM Ping An FTSE ASEAN Dividend Index ETF. We break down how it could offer investors a more diversified source of passive income, and the key risks to be mindful of.

Finally, with the 1-year T-bill yield rising to 1.44% in the latest auction, we look at what to expect for the upcoming 6-month T-bill auction on 29 January. We also discuss whether it’s worth applying for the current Singapore Savings Bond (SSB), which offers a 10-year average return of 2.25%.

If you’re finding it hard to stay consistent with your financial goals, maybe the best way is to start with what feels easiest, and take one small step forward from there.

Happy growing!

Gerald, Founder of Beansprout

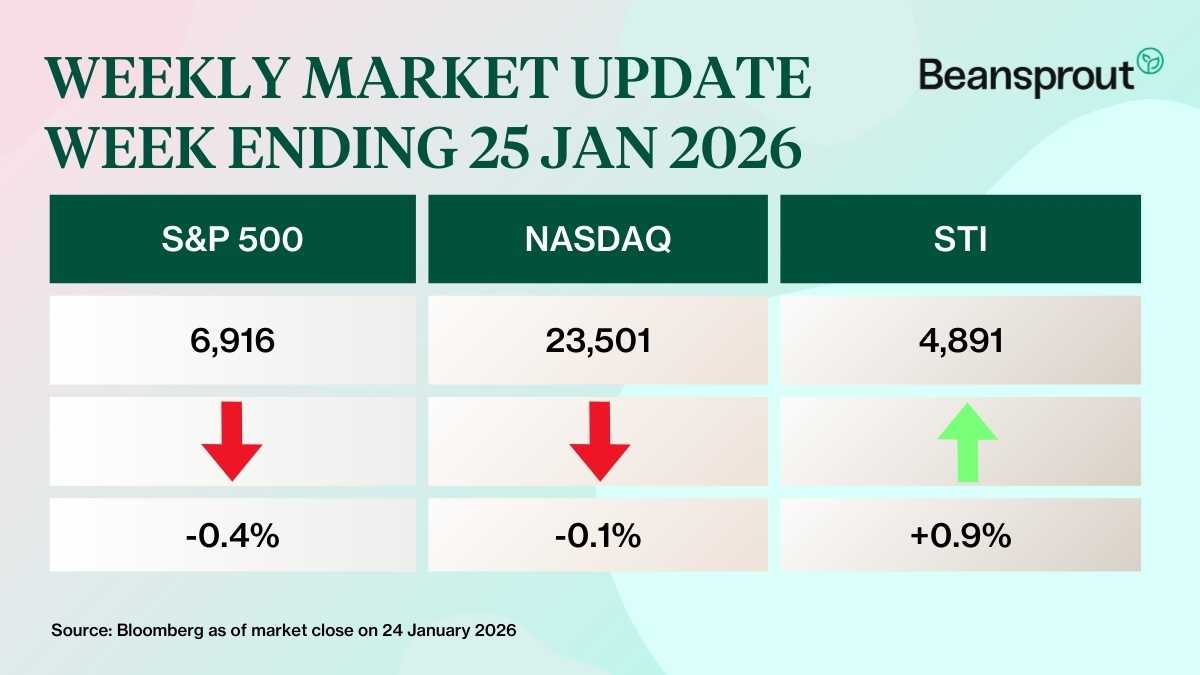

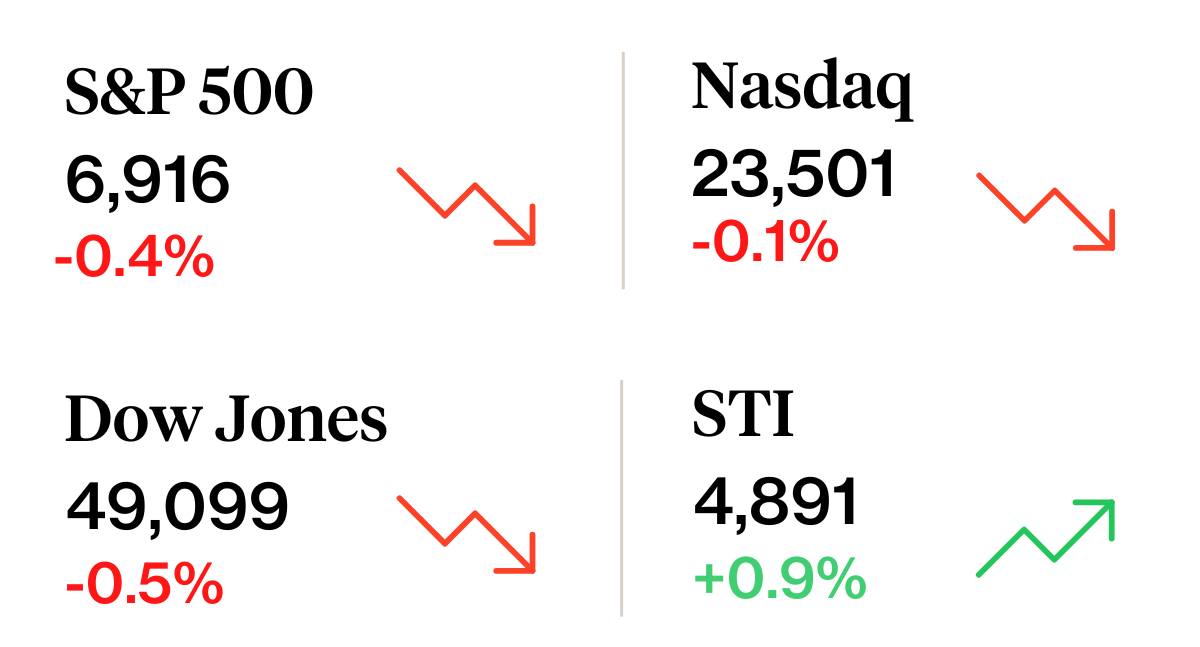

⏰ This Week In Markets

🚀 Singapore stocks gain momentum

What happened?

Singapore stocks gained further momentum this week, with the Straits Times Index (STI) rising for the third consecutive week since the start of the year and reaching a new all time high.

This came after Bloomberg reported that the Monetary Authority of Singapore (MAS) has started deploying part of the S$5 billion to selected fund managers to invest in local stocks, as part of efforts to revive the Singapore equity market.

New listings also continued to pick up pace, with two new listings from Toku and The Assembly Place.

What does this mean?

The fresh capital flowing into the Singapore stock market comes amid a positive economic backdrop and renewed interest in safe haven markets as global geopolitical uncertainty remains elevated.

Earlier, the Ministry of Trade and Industry shared that Singapore’s GDP grew by 4.8% in 2025, up from 4.4% growth in 2024.

This week, the Building and Construction Authority (BCA) also projected S$47 to S$53 billion in construction contracts for 2026 driven by major projects such as Changi Terminal 5., sustaining momentum from S$50.5 billion awarded in 2025,

Why should I care?

Singapore stocks continued to hold up well even as US stocks softened amid geopolitical uncertainty.

Several Singapore blue chip stocks reached new highs, including UOB and OCBC, while DBS came close to its previous peak.

Precious metals also stayed in focus, with gold and silver continuing to hit new highs as investors looked for defensive assets.

Learn more about why investors include gold in their portfolios, and examine what is driving the recent rally and whether it can be sustained.

Find out how to buy gold in Singapore here and how to buy silver in Singapore here.

🚗 Moving This Week

- Singapore Airlines and Air India signed a cooperation framework on Jan 16 to deepen their partnership and improve Singapore–India connectivity, subject to regulatory approvals, with plans to expand route options, coordinate schedules and enable single-itinerary bookings across both airlines. Read more here.

- Keppel said it has entered into a binding term sheet with a global telecommunications company to lease a fibre pair on the Bifrost Cable System for 25 years. The Bifrost Cable System is a 20,000 km trans-Pacific submarine cable that directly links Singapore to the west coast of the US via Indonesia, the Java Sea and the Celebes Sea. Read more here.

- CapitaLand Investment (CLI) is targeting growth opportunities in the Gulf, focusing on the fast-expanding logistics and hospitality sectors as oil-producing nations diversify their economies. Read more here.

- Suntec Reit posted a distribution per unit of S$0.0388 for the second half ended Dec 31, 2025, up 23.2 per cent from S$0.0315 a year earlier. Revenue in H2 FY2025 edged up 0.2 per cent to S$237.1 million. The increase was supported by higher contributions from its Singapore and London properties, which offset weaker revenue from two Australian assets. Read more here.

Source: Bloomberg, CNBC, Business Times, Edge Singapore

💡 The Big Important Story

A simple way to diversify passive income beyond Singapore stocks

Looking beyond Singapore for passive income? Learn how the UOBAM Ping An FTSE ASEAN Dividend Index ETF offers ASEAN diversification and dividend potential.

🤓 What we're looking out for next week

- Monday, 26 January 2026: Mapletree Logistics Trust, OUE REIT earnings

- Wednesday. 28 January 2026: Mapletree Industrial Trust earnings, Beansprout webinar: Investing in the Living Sector: A growing real estate asset class, Microsoft, Meta, Tesla earnings

- Thursday, 29 January 2026: CapitaLand Ascott Trust, Starhill Global REIT earnings, 6-month Singapore T-bill auction, Apple earnings

- Friday, 30 January 2026: Keppel DC REIT, CDL Hospitality Trusts, Mapletree Pan Asia Commercial Trust earnings

Get the full list of stocks with upcoming dividends here.

Source: SGX, Bloomberg, Refinitiv

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments